In relation to financial, the teller windows is a crucial section of the process. Consumers rely on tellers to handle their dealings, and banking companies rely on efficient tellers to keep their teller window functions working well. But what makes the teller windows this type of essential element of a bank’s achievement? On this page, we’ll check out the significance of effectiveness on the teller window and just how banking companies can optimize their teller procedure.

Streamlining the Purchase Method: With regards to handling dealings, velocity and accuracy are very important. Customers would like to get inside and out from the financial institution quickly using their dealings completed appropriately. Banking companies that improve their teller home window operations provides faster service to their customers, reducing wait around times, and enhancing general customer satisfaction. By streamlining the financial transaction method, tellers can assist much more consumers and transfer outlines quicker.

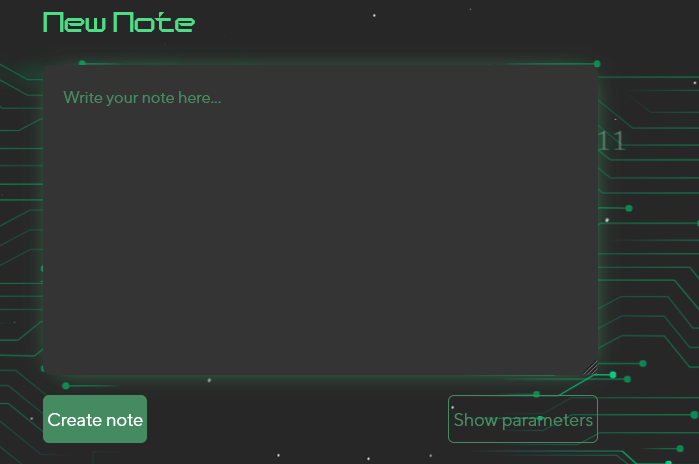

Electronic Improvement: As technologies continues to move forward, financial institutions are looking for ways to digitize their processes and reduce the reliance upon pieces of paper-based transactions. Applying computerized remedies like funds recyclers, digital signatures, and automated teller machines can help minimize income handling and enhance total effectiveness. These alternatives could also get back tellers’ time and permit them to concentrate on more complex client requirements, such as financial assistance and evaluation.

Training and Help: To enhance effectiveness at the teller window, it’s essential to have well-skilled tellers. Teller education should protect everything from purchase managing to customer support capabilities. Banks also needs to provide tellers with on-going help, like training and gratification opinions, to assist them boost their abilities and remain interested. A nicely-skilled and inspired teller staff are equipped for high amounts of purchases successfully.

Customer Satisfaction: The teller windowpane is often the very first reason for contact between a financial institution and its particular buyers. As such, it’s essential to offer outstanding customer service all the time. This includes from greeting customers with a smile to dealing with dealings efficiently and precisely. Banking institutions that prioritize customer support at the teller window will develop more powerful relationships using their clients, enhancing preservation and devotion.

Data and Statistics: Banking companies gain access to huge amounts of information, and using that data may help improve the teller home window procedure. By tracking financial transaction quantities, wait occasions, and teller overall performance, financial institutions can establish bottlenecks and places for enhancement. With this particular information, financial institutions can change staffing levels, coaching courses, and technologies methods to maximize efficiency on the teller windowpane.

Simply speaking:

The teller windowpane might appear to be a small section of the financial approach, but it really has an important role within the general achievement of the bank. By optimizing the teller window procedure through streamlining transactions, electronic change, worker training, customer satisfaction concentration, and data google analytics can cause enhanced client satisfaction, greater purchase quantity, and finally, a successful banking organization. Financial institutions that prioritize performance in the teller home window will be better placed to weather any hard storms which may appear their way in the future.